India’s decrease space of parliament on Wednesday handed a sweeping on-line gaming invoice that, whilst selling esports and informal gaming with out financial stakes, imposes a blanket ban on real-money video games — threatening to disrupt billions of bucks in funding and considerably affect the real-money gaming trade, which might see popular shutdowns.

Titled the Promotion and Law of On-line Gaming Invoice, 2025, the regulation objectives to ban real-money video games national — whether or not in keeping with ability or probability — and ban each their commercial and related monetary transactions, as TechCrunch previous reported in keeping with its draft model.

“On this invoice, precedence has been given to the welfare of society and to keep away from a large evil this is creeping into society,” India’s IT minister Ashwini Vaishnaw stated in parliament whilst introducing the invoice.

The proposed regulation restricts banks and different monetary establishments from permitting transactions for real-money video games within the nation. Someone providing those video games may face imprisonment for as much as 3 years, a high quality of as much as ₹10 million (roughly $115,000), or each. Moreover, celebrities selling such video games on any media platform may well be chargeable for as much as two years of imprisonment or a high quality of ₹5 million (kind of $57,000), the invoice states.

Vaishnaw stated the verdict to carry the regulation was once to deal with a number of incidents of damage, together with circumstances the place folks reportedly died via suicide after shedding cash in video games. Alternatively, trade stakeholders in large part characteristic those incidents to offshore having a bet and playing apps, which many imagine is probably not addressed via this regulation.

“This legislation is certain to stand litigation because it fails the check of proportionality below Article 19(1)(g),” stated Meghna Bal, director of the New Delhi-based think-tank Esya Centre. “As a substitute of safeguarding customers, it dismantles compliant onshore corporations whilst opening the door wider for unlawful offshore having a bet platforms which can be the genuine supply of monetary hurt.”

Article 19(1)(g) of India’s Charter promises electorate the fitting to follow any occupation or elevate on any profession, business, or trade.

Techcrunch tournament

San Francisco

|

October 27-29, 2025

Forward of the invoice’s creation within the Indian Parliament, trade our bodies wrote to Top Minister Narendra Modi on Tuesday night time, urging him to interfere. The letter — despatched via the Federation of Indian Fable Sports activities, All India Gaming Federation, and E-Gaming Federation, a replica of which was once reviewed via TechCrunch — warned that the proposed regulation may get advantages “unlawful offshore playing operations” whilst forcing Indian companies to close down. Those trade our bodies constitute Dream Sports activities, MPL, WinZO, Gameskraft, Nazara Applied sciences, and Zupee, amongst different real-money gaming corporations.

“Through shutting down regulated and accountable Indian platforms, it’ll power [millions] of avid gamers into the palms of unlawful matka networks, offshore playing internet sites, and fly-by-night operators who perform with none safeguards, shopper protections, or taxation,” the letter mentioned. (Matka is a type of unlawful playing that originated in India, involving having a bet on random numbers.)

The 3 trade our bodies estimated that real-money gaming startups in India have a blended endeavor valuation of ₹2 trillion (roughly $23 billion), generate cumulative revenues of ₹310 billion (round $3.6 billion), and give a contribution ₹200 billion (kind of $2.29 billion) once a year in direct and oblique taxes. In addition they mission a 28% compound annual expansion price that might double the trade’s measurement via 2028. The trade teams warned that the blanket ban may end result within the lack of greater than 200,000 jobs and the closure of over 400 corporations.

A equivalent letter was once additionally written to Indian House Minister Amit Shah via those 3 trade associations. Some Indian and world buyers also are calibrating their reaction, an individual aware of the topic instructed TechCrunch. The supply didn’t wish to be named, because the plans don’t seem to be but public.

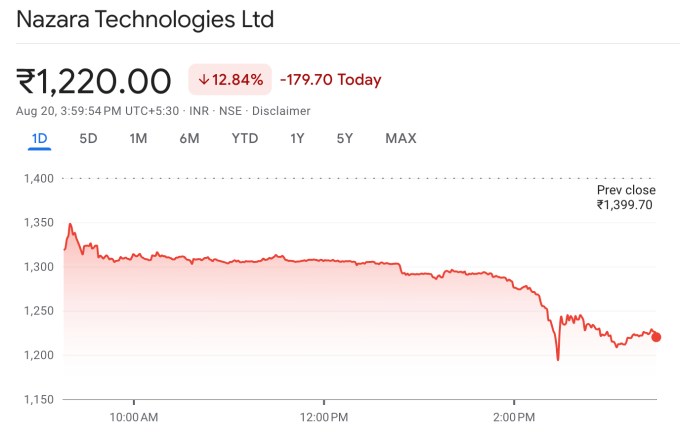

Publicly-listed Nazara Applied sciences, which has in the past invested in real-money gaming platforms together with PokerBaazi and Vintage Rummy, noticed its percentage worth fall 12.84% on Wednesday to near at ₹1,220 (about $14). The corporate, then again, previous clarified in a inventory change submitting (PDF) that it has “no direct publicity” to real-money gaming companies and that those platforms don’t give a contribution to its revenues in keeping with its newest reported financials.

Dream Sports activities and MPL, two of the highest real-money gaming startups, declined to remark, whilst WinZO, any other fashionable real-money startup, didn’t reply.

The invoice was once handed via voice vote in a loud decrease space lower than seven mins after it was once offered for debate. It now calls for approval from the higher space and the president to grow to be legislation.

In the meantime, some corporations in informal gaming and esports have welcomed the transfer.

“We applaud this resolution because it lets in us to concentrate on the continuing considerations as a trade — monetization, retention, and most significantly, construction nice IP for India and the sector, somewhat than having to provide an explanation for to our audiences what we’re initially,” stated Sumit Batheja, CEO and co-founder of Ginger Video games, which is a part of Krafton’s Indian gaming incubator and makes hyper informal video games.

Krafton is the South Korean gaming corporate in the back of the preferred combat royale sport PUBG.

Akshat Rathee, co-founder and managing director of esports corporate NODWIN Gaming, which may be a subsidiary of Nazara Applied sciences, stated the legislation must have transparent distinctions between esports, on-line gaming, on-line social gaming, and on-line cash gaming which can be obviously outlined and uniformly understood.

“The absence of actual definitions has continuously ended in ambiguity and conflation across the time period ‘esports’. Such overlaps can create confusion no longer only for regulators, but additionally for avid gamers, groups, buyers, and organizers who’re running arduous to construct this trade,” he mentioned.

Bal additionally instructed TechCrunch that the invoice “decimates esports,” as an expert arrange via the Indian govt would come to a decision the validity of esports.

“The affect is going past genuine cash gaming to the wider ecosystem of companies that rely on it and certainly gifts grave implications for the AVGC [Animation, Visual Effects, Gaming, and Comics] sector as a complete,” she stated.

In 2023, the Indian govt amended the Data Generation (Middleman Pointers and Virtual Media Ethics Code) Regulations, 2021, to curb “person hurt” from real-money video games and proposed self-regulatory our bodies to restrict unlawful having a bet and playing whilst permitting professional video games. Alternatively, the self-regulation means faltered because of conflicts amongst trade stakeholders over enforcement and requirements.

New Delhi imposed a 28% tax on on-line gaming in 2023 to curb real-money play, prompting an outcry from trade stakeholders. Best buyers — together with Tiger International, Height XV Companions, and Kotak —advised Modi to rethink, caution of $2.5 billion in write-offs and the prospective lack of 1,000,000 jobs. The tax, then again, remained in position, whilst corporations challenged its retrospective utility within the Superb Court docket. Contemporary stories counsel it can be revised upward to 40% below new regulations.

Rohit Kumar, a founding spouse of the New Delhi-based public coverage company The Quantum Hub, instructed TechCrunch that the genuine downside with the brand new invoice is a loss of due procedure.

“Law is essential, however abrupt strikes like this undermine India’s popularity as a strong, predictable funding vacation spot. If considerations existed, the federal government will have to have signaled them obviously from the outset,” he stated.