Pintarnya, an Indonesian employment platform that is going past task matching by means of providing monetary services and products at the side of full-time and side-gig alternatives, stated it has raised a $16.7 million Collection A spherical.

The investment was once led by means of Sq. Peg with participation from present buyers Vertex Mission Southeast Asia & India and East Ventures.

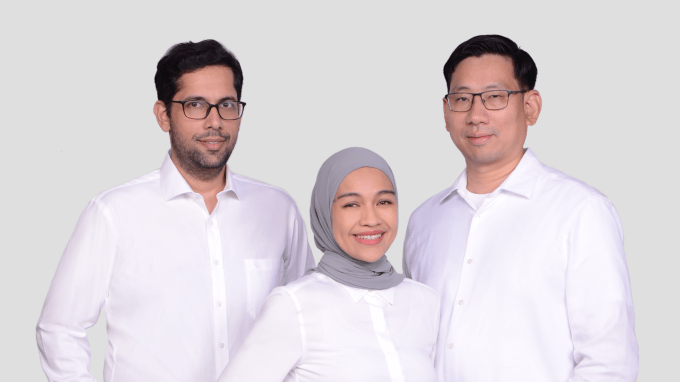

Ghirish Pokardas, Nelly Nurmalasari, and Henry Hendrawan based Pintarnya in 2022 to take on two of the most important demanding situations Indonesians face day-to-day: incomes sufficient and borrowing responsibly.

“Historically, mass employees in Indonesia in finding jobs offline thru task gala’s or phrase of mouth, with employers buried in paper packages and applicants hardly ever listening to again. For borrowing, their choices are steadily restricted to circle of relatives/pal or predatory lenders with harsh assortment practices,” Henry Hendrawan, co-founder of Pintarnya, instructed TechCrunch. “We digitize task matching with AI to make hiring sooner and we offer employees with more secure, more healthy lending choices — designed round what they are able to moderately have enough money, relatively than pushing them deeper into debt.”

Round 59% of Indonesia’s 150 million staff is hired within the casual sector, highlighting the difficulties those employees come across in gaining access to formal monetary services and products as a result of they lack verifiable source of revenue and professional employment documentation.

Pintarnya tackles this problem by means of partnering with asset-backed lenders to supply secured loans, the use of collateral equivalent to gold, electronics, or automobiles, Hendrawan added.

Since its seed investment in 2022, the platform these days serves over 10 million task seeker customers and 40,000 employers national. Its income has larger nearly fivefold year-over-year and expects to achieve break-even by means of the tip of the 12 months, Hendrawn famous. Pintarnya basically serves customers elderly 21 to 40, maximum of whom have a highschool schooling or a degree underneath college stage. The startup targets to concentrate on this underserved phase, given the massive inhabitants of blue-collar and casual employees in Indonesia.

Techcrunch tournament

San Francisco

|

October 27-29, 2025

“Throughout the adventure of establishing employment services and products, we came upon that our customers wanted extra than simply jobs — they wanted get admission to to monetary services and products that conventional banks couldn’t supply,” stated Hendrawan. “We digitize task matching with AI to make hiring sooner and we offer employees with more secure, more healthy lending choices — designed round what they are able to moderately have enough money, relatively than pushing them deeper into debt.”

Whilst Indonesia already has task platforms like JobStreet, Kalibrr, and Sparkles, those basically cater to white-collar roles, which constitute just a small portion of the staff, in line with Hendrawan. Pintarnya’s platform is designed in particular for blue-collar employees, providing adapted studies equivalent to quick-apply choices for walk-in interviews, reasonably priced e-learning on related abilities, in-app alternatives for supplemental source of revenue, and seamless connections to monetary services and products like loans.

The similar pattern is obvious in Indonesia’s fintech sector, which in a similar fashion caters to white-collar or upper-middle-class shoppers. Typical credit score scoring fashions for loans, which depend on stable per 30 days source of revenue and checking account process, steadily depart blue-collar employees overpassed by means of present fintech suppliers, Hendrawan defined.

When requested about which fintech services and products are maximum in call for, Hendrawan discussed, “Given their employment standing, lending is essentially the most in-demand monetary carrier for Pintarnya’s customers as of late. We’re making plans to ‘graduate’ them to micro-savings and investments down the street thru leading edge merchandise with our companions.”

The brand new investment will permit Pintarnya to toughen its platform era and develop its monetary carrier choices thru strategic partnerships. With maximum Indonesian employees hired in blue-collar and casual sectors, the co-founders see really extensive expansion alternatives within the native marketplace. Leveraging their intensive revel in in managing companies throughout Southeast Asia, they’re additionally open to exploring regional enlargement when the timing is true.

“Our imaginative and prescient is for Pintarnya to be the on a regular basis significant other that empowers Indonesians not to handiest make ends meet as of late, but in addition plan, develop, and improve their lives the next day to come … In 5 years, we see Pintarnya because the go-to tremendous app for Indonesia’s employees, no longer only for incomes source of revenue, however as a depended on spouse all through their lifestyles adventure,” Hendrawan stated. “We need to be the primary prevent when any individual is on the lookout for paintings, a spot that is helping them improve their abilities, and a competent information as they make monetary selections.”