Unencumber, an AI startup automating insurance coverage operations, has raised $50 million in a spherical led through Battery Ventures because it seems to be to scale its agentic deployments throughout carriers and businesses globally.

The all-equity spherical values the three-year-old startup at $300 million post-money, with participation from new investor Canapi Ventures and returning backers Redpoint Ventures, Eclipse, and Trade Ventures.

The insurance coverage trade has been navigating a troublesome stretch, with emerging operational prices, legacy device constraints, and lengthening buyer expectancies. In particular within the non-life phase, international top class expansion is projected to sluggish thru 2026, pushed through heightened festival, weaker fee momentum, and new price pressures, together with price lists, in step with a fresh document through Deloitte. Whilst some carriers experimented with AI, many early efforts stalled because of fragmented information and rigid workflows. This is now converting, as insurers shift towards full-scale AI adoption — embedding it into the core in their operations reasonably than layering it on most sensible. Unencumber is stepping in to satisfy this shift head-on.

Based in 2022, the San Francisco-based startup builds AI programs for assets and casualty insurers, that specialize in gross sales, provider, and claims. On the entrance finish, its voice AI assistant, Nichole, can position outbound calls to shoppers to lend a hand promote insurance policies or reply to provider requests. In the back of the scenes, a community of reasoning-based AI brokers connects to insurers’ present programs, collecting context and producing responses that Nichole delivers — all with out human intervention.

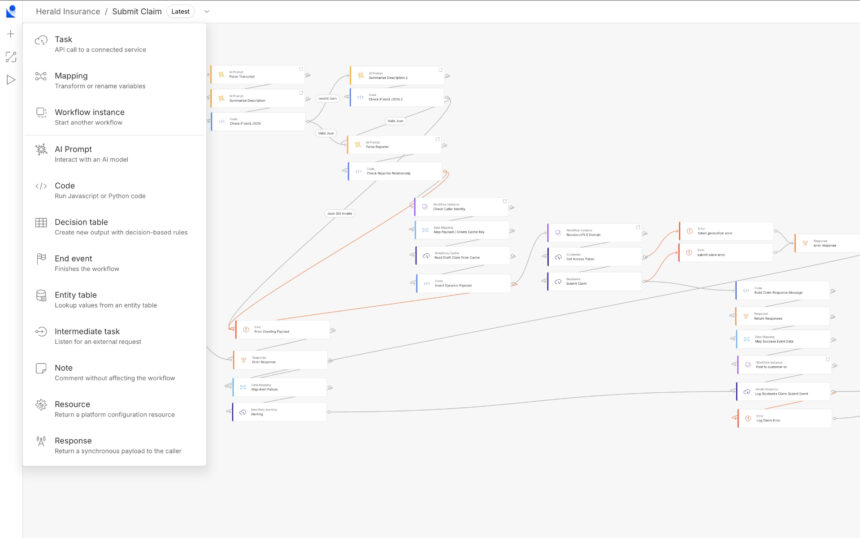

Unencumber’s AI brokers are constructed to finish end-to-end duties — no longer simply reply to queries or escalate tickets. Those come with quoting insurance policies, processing claims, and updating endorsements, amongst different regimen purposes.

The brokers too can function over SMS and e-mail, permitting insurers to have interaction with shoppers throughout other channels whilst automating extra in their daily workflows.

“Insurance coverage corporations need to develop, however they’re no longer in a position to take action,” Unencumber co-founder and CEO Amrish Singh (pictured above, middle) mentioned in an interview. “It’s the established order the place the chance is.”

Techcrunch tournament

San Francisco

|

October 27-29, 2025

Singh co-founded Unencumber after just about 4 years at Metromile, the automobile insurance coverage company owned through Lemonade, the place he labored throughout each back-office operations and generation. He teamed up with Ryan Eldridge, Unencumber’s CTO and in addition a former Metromile govt, and Jason St. Pierre, the corporate’s CPO, who up to now held roles at Twitter, Google, and Verily, Alphabet’s lifestyles sciences arm.

Unencumber’s AI programs have helped build up gross sales through a mean of 15% and minimize prices through 23%, Singh instructed TechCrunch, including that the startup now has over 60 shoppers and specializes in the highest 100 carriers and businesses, which in combination constitute 70% to 80% of the U.S. assets and casualty insurance coverage marketplace.

The generation makes use of reinforcement finding out adapted for lengthy, regulated insurance coverage conversations. Each and every interplay is auditable and contains human-in-the-loop safeguards to satisfy compliance necessities, the startup mentioned.

During the last yr, Unencumber has scaled from 10,000 per thirty days automations to one.3 million automatic resolutions, Singh said. Those come with direct buyer interactions by way of its voice AI, in addition to back-office duties treated through AI brokers built-in into carriers’ core programs.

Since AI programs can nonetheless make errors and don’t seem to be foolproof but, Unencumber makes use of an interior software known as Manager to watch all interactions between its brokers and shoppers. The tool flags problems or anomalies and escalates to a human when the AI’s reaction is also off-track, Singh mentioned.

“The benefit of servicing just one trade, and inside of that servicing best 3 particular use circumstances, is that you’ll be able to put much more guardrails in position,” the manager famous.

With out disclosing the names of its shoppers, Unencumber mentioned that the usage of its brokers, typhoon declare reaction time dropped from 30 hours to 30 seconds.

The AI brokers allow 24/7 gross sales operations, permitting shoppers to shop for insurance coverage even at nighttime or early within the morning — instances when human brokers in most cases don’t seem to be to be had, Singh mentioned.

Prior to this spherical, Unencumber raised $15 million in Sequence A final yr. Its voice AI–powered omnichannel revel in and talent to totally automate duties through integrating into present programs have been key elements that drew traders to again the corporate at a bigger scale.

“Mapping the method, modeling it, and ensuring that all of the programs connections are in position, neatly examined, and accurately designed so as to whole the duty, no longer simply keep up a correspondence, is what Unencumber is doing,” Marcus Ryu, a basic spouse at Battery Ventures, instructed TechCrunch.

Ryu, who up to now labored with assets and casualty insurers at Guidewire Instrument, specializes in undertaking tool, fintech, and insurtech investments at Battery Ventures. He’s becoming a member of Unencumber’s board.

The Sequence B investment will probably be used to extend Unencumber’s reasoning features and fortify broader deployment throughout insurers. The startup has raised $72 million to this point and these days employs round 50 folks.