The Ferrero Workforce stated Thursday it is going to purchase WK Kellogg Co. in a deal valued $3.1 billion, increasing the Italian meals large’s international achieve.

Kellogg, which was once based in Fight Creek, Michigan, in 1906, is understood for manufacturers together with Corn Flakes, Froot Loops, Rice Krispies and Particular Okay. Ferrero’s manufacturers come with Nutella and Rocher sweets.

The deal will come with production, advertising and distribution oKellogg’s portfolio of cereal manufacturers within the U.S., Canada and the Caribbean, the cereal maker stated.

Ferrero pays $23 for every WK Kellogg proportion. Kellogg’s inventory surged greater than 35% to to $22.86 in early industry.

In 2023, Kellogg spun of snack manufacturers like Cheez-Its and Pringles right into a separate corporate known as Kellanova. M&M’s maker Mars introduced closing 12 months that it deliberate to shop for Kellanova in a deal price just about $30 billion.

Brad Haller, a senior spouse at consulting company West Monroe, stated in an e-mail that the purchase indicators consolidation within the meals and beverage sector, “as international gamers search scale and class breadth to navigate moving shopper personal tastes and heightened pageant.”

The deal comes as Ferrero, which was once introduced Italy in 1946, seeks to develop its achieve within the U.S. and different global markets. In 2018, the corporate purchased Nestle’s U.S. sweet manufacturers, which come with Butterfinger, Nerds and SweeTarts. 4 years later, it got Wells Enterprises, which is in the back of ice cream manufacturers Blue Bunny and Halo Best.

The $3.1 billion deal can even supply some monetary respiring room to Kellogg.

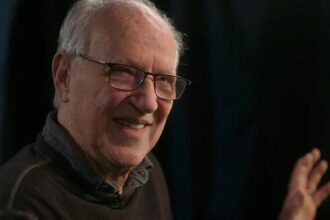

“Becoming a member of Ferrero will supply WK Kellogg Co. with larger assets and extra flexibility to develop our iconic manufacturers on this aggressive and dynamic marketplace,” CEO Gary Pilnick stated in a commentary.

Kellogg on Tuesday reported $663 million in internet gross sales in its first-quarter profits, a 6.2% lower from a 12 months in the past. In its profits commentary, the corporate discussed that it’s ramping up its center of attention on well being and vitamin in accordance with shopper personal tastes.

The purchase is predicted to near in the second one part of this 12 months, consistent with Kellogg. After the transaction is finished, the corporate’s stocks will now not industry at the New York Inventory Alternate, Kellogg stated.

contributed to this document.