Whilst short trade in India has transform synonymous with 10-minute deliveries — and the freshest play for startups and buyers — FirstClub is taking a slower, extra curated course. But simply 3 months after launching its app, the eight-month-old startup has tripled its valuation.

At a post-money valuation of $120 million, the Bengaluru-based startup has raised $23 million in a Collection A spherical (comprising greater than 90% fairness and the remaining in debt) co-led through returning buyers Accel and RTP World. The spherical additionally noticed participation from Blume Founders Fund, 2am VC, Paramark Ventures, and Aditya Birla Ventures. This new investment comes simply 8 months after FirstClub raised its $8 million seed spherical at a $40 million valuation in December.

E-commerce in India — the arena’s second-largest client base — has surged to roughly $60 billion in gross products worth (GMV) and is predicted to develop at 18% once a year, attaining $170–$190 billion through 2030, according to a up to date Bain & Corporate file. Just about one in each ten retail bucks in India is projected to be spent on-line through the tip of the last decade. Over the last few months, the marketplace has shifted from conventional e-commerce, the place deliveries normally took two to a few days, to ultra-fast success — mainly pushed through the upward thrust of quick-commerce startups. This shift has even caused incumbents like Amazon and Walmart-owned Flipkart to go into the fray with their very own fast supply choices.

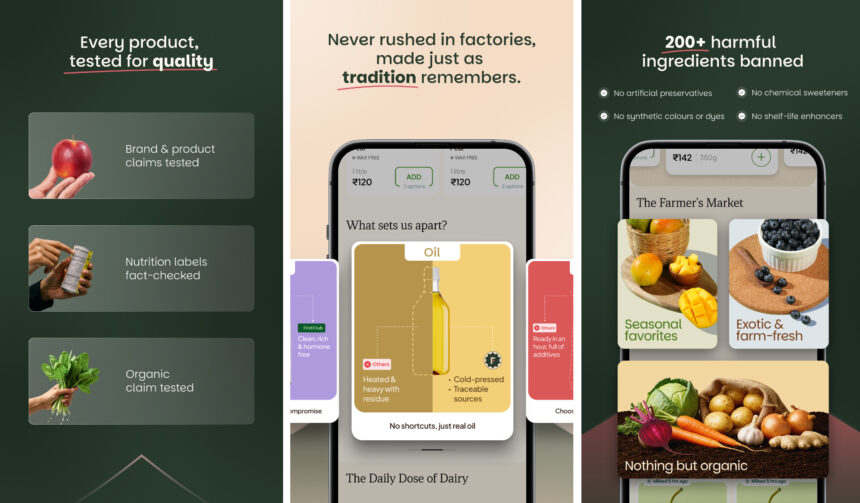

Alternatively, FirstClub sees an opening: moderately than racing to be the quickest, the startup is making a bet on high quality. It’s concentrated on the end 10% of Indian families — kind of 20 million of them — with top class merchandise and a curated enjoy.

Introduced in June, the startup these days serves shoppers in a couple of localities of Bengaluru with 4 darkish shops, which it calls “clubhouses.” Darkish shops are success facilities that appear to be retail shops however serve most effective on-line orders. The corporate shares over 4,000 curated stock-keeping gadgets from manufacturers throughout packaged meals, recent produce, bakery, dairy, and diet.

“Primarily based the final 3 months’ knowledge, it’s reasonably transparent that customers are satisfied to attend if they’re getting an overly differentiated variety, a just right high quality of goods, a differentiated provider, and an overly hand-holding type of an enjoy,” mentioned Ayyappan R, founder and CEO of FirstClub, in an interview.

The startup these days sees a mean order worth of ₹1,050 (roughly $12) — about two times that of main quick-commerce platforms when handing over groceries — together with a 60% repeat acquire charge, the chief instructed TechCrunch.

Techcrunch tournament

San Francisco

|

October 27-29, 2025

The founder hit the bottom working with enjoy beneath his belt. Prior to founding FirstClub in December, Ayyappan spent over a decade at Flipkart, India’s biggest homegrown e-commerce corporate, the place he led groups at its subsidiaries Myntra (a way e-commerce website online) and Cleartrip (a shuttle reserving website online). He was once up to now a part of the workforce at Indian client items massive ITC, that specialize in methods to make bigger grocery marketplace and outlet protection. The ones studies helped him temporarily flip FirstClub from an idea right into a trade.

“In a span of six months, we’ve been ready to construct an end-to-end tech platform,” he recalled.

The startup has additionally established its personal provide chain community and partnered with make a choice manufacturers to provide unique merchandise. These days, 60% of the goods on its platform are unique.

“We don’t seem to be indexing at the supply pace, however we say that the goods you get right here, you wouldn’t to find somewhere else, if it is offline or on-line,” Ayyappan instructed TechCrunch.

FirstClub has additionally employed a third-party client panel to check merchandise that will likely be featured on its platform.

“If I take an instance of, say, paneer (cottage cheese in Hindi), 20 merchandise from very, very other manufacturers of paneer are examined through this client panel, which is completed as a blind check, and no matter comes as the most efficient, the top-three merchandise, those gets onto the platform,” the founder mentioned.

The startup started its adventure with grocery as the primary class. It discovered that whilst the contest is reasonably intense on this house, with maximum short trade firms, together with Blinkit and Swiggy’s Instamart, providing groceries via their platforms, there’s room for a differentiated collection of premium-quality pieces, Ayyappan mentioned.

Growth plans fueled through recent investment

FirstClub objectives to make bigger past groceries into new classes, together with kids’s meals, dog food, and nutraceuticals. It’s venturing into cafes within the subsequent 30 days, Ayyappan instructed TechCrunch, with a differentiated means that won’t come with preheated meals however as a substitute freshly made pieces.

The startup additionally plans to go into the house and common products classes inside the subsequent six months. This may come with house decor, house necessities, house care, furnishing, or even utensils, the founder mentioned.

FirstClub’s buyer base is 70% ladies. Because of this, the corporate no longer most effective curates merchandise adapted to them however may be increasing into classes maximum related to their wishes.

Sharing extra buyer insights, Ayyappan instructed TechCrunch that FirstClub’s shoppers are essentially within the source of revenue bracket of ₹1.5 million (round $17,000) annual family source of revenue. The startup prevents shoppers from trying out if their cart worth is beneath ₹199 (kind of $2.40) to make a choice the suitable shoppers.

Additional, the app is designed for a browser-led enjoy moderately than a search-led one, which is conventional of maximum short trade platforms. This means encourages customers to spend extra time exploring choices, making improvements to retention and enabling the startup to ship a curated enjoy in accordance with buyer insights. The startup has additionally banned from its provide chain merchandise containing over 200 substances that may hurt shoppers, the founder mentioned.

“Everyone’s like, ‘I’ll be offering a big variety and let the patron make a choice what they would like,’ as opposed to the platform taking possession — announcing each unmarried product it sells must be top-notch high quality,” Ayyappan famous.

FirstClub necessarily desires to carry the type of enjoy that outlets like Costco, Complete Meals, Dealer Joe’s, and TJ Maxx be offering in North The usa, the founder mentioned.

“We wish to be provide to the shoppers throughout a couple of channels and a couple of platforms,” he mentioned. “More than likely a slotted supply, subscription supply, offline, so all of those would come into the image as neatly.”

With the recent investment, the startup additionally plans to make bigger its clubhouses to as much as 35, protecting maximum of Bengaluru this yr, ahead of coming into a brand new town.

“We would possibly invite the shoppers to our clubhouses as neatly to exhibit that is how hygienic [they are], and that is how we handle the standard,” Ayyappan mentioned.

The startup these days has a headcount of 185 staff, together with a 75-person operational body of workers.