Amid the entire “is that this a bubble?” speak about synthetic intelligence, the provision chain and logistics industries have turn out to be breeding grounds for apparently authentic makes use of of the era. Flexport, Uber Freight, and dozens of startups are creating other packages and profitable blue-chip consumers.

However whilst AI is helping Fortune 500s pad their base line (and justify the following layoff to Wall Side road), the suitable use of the tech is proving helpful to smaller companies.

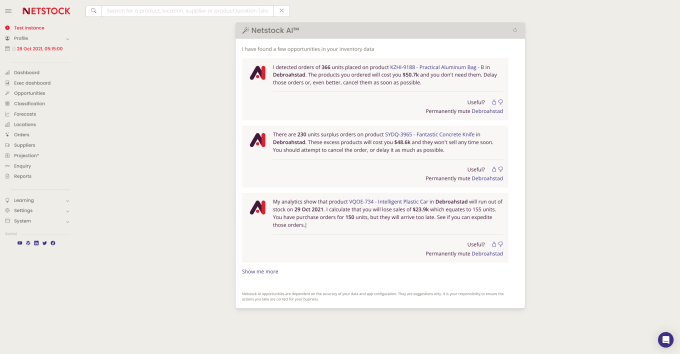

Netstock, a listing control tool corporate based in 2009, is operating on simply that. It just lately rolled out a generative AI-powered instrument referred to as the “Alternative Engine” that slots into its present buyer dashboard. The instrument pulls information from a buyer’s Endeavor Useful resource Making plans tool and makes use of that knowledge to make common, real-time suggestions.

Netstock claims the instrument is saving the ones companies hundreds. On Thursday, the corporate introduced it has served up a million suggestions up to now, and that 75% of its consumers have gained an Alternative Engine recommendation valued at $50,000 or extra.

Whilst tantalizing, a type of consumers — Bargreen Ellingson, a family-run 65-year-old eating place provide corporate — used to be to begin with worried about the use of a synthetic intelligence product.

“Previous kin firms don’t consider blind exchange so much,” leader innovation officer Jacob Moody instructed TechCrunch. “I may now not have long gone into our warehouse and mentioned, ‘Howdy, this black field goes to begin managing.’”

As an alternative, Moody pitched Netstock’s AI internally as a device that warehouse managers may “both make a selection to make use of, or now not use” — a procedure he describes as “eagerly, however cautiously dipping our ft” into AI.

Techcrunch match

San Francisco

|

October 27-29, 2025

Moody says it’s serving to steer clear of errors, partly as it’s sifting via myriad experiences his team of workers makes use of to make stock choices. He said the AI summaries of this information don’t seem to be 100% correct, however mentioned it “is helping create indicators from the noise” briefly, particularly all through off-hours.

The “extra profound” exchange Moody’s spotted is the tool made a few of Bargreen Ellingson’s less-senior warehouse team of workers “more practical.”

He highlighted an worker in considered one of Bargreen’s 25 warehouses who’s labored there for 2 years. The worker has a highschool degree however no school stage. Coaching this worker to grasp the entire stock control gear and the forecasting knowledge Bargreen makes use of to devise stock ranges will take time, he mentioned.

“However he is aware of our consumers, he is aware of what he’s striking at the truck each day, so for him, he can have a look at the gadget and feature this prosaic AI-driven perception and in no time perceive whether or not it is smart or doesn’t make sense,” he mentioned. “So he feels empowered.”

Netstock cofounder Kukkuk instructed TechCrunch that he understands the hesitancy round new applied sciences — particularly as a result of such a lot of merchandise are necessarily mediocre chatbots hooked up to present tool.

He attributes the early luck of Netstock’s Alternative Engine to a couple of issues. The corporate has greater than a decade’s value of information from running with shops, vendors, and light-weight producers. That knowledge is tightly secure to stick to ISO frameworks, but it surely’s what powers the fashions that make the suggestions. (He mentioned Netstock is the use of a mix of AI tech from the open supply neighborhood and personal firms.)

Every advice will also be rated with a thumbs up or thumbs down, however the fashions additionally get bolstered through whether or not the buyer takes the instructed motion or now not.

Whilst that more or less reinforcement studying may end up in bizarre, now and again destructive effects when implemented to such things as social media, Kukkuk mentioned he’s chasing other incentives.

“I don’t in point of fact care about eyeballs, you realize?” he mentioned. “Fb and Instagram care about eyeballs, so they would like you to take a look at their stuff. We care about: ‘what’s the end result for the buyer?”

Kukkuk’s cautious of increasing the ones interactions because of the constraints of present generative AI tech. Whilst it will make sense for a buyer to speak with Netstock’s AI about why a advice is or isn’t helpful, Kukkuk mentioned that might in the long run result in a breakdown in accuracy.

“It’s a tightrope to stroll, since the extra freedom you give the customers, the extra freedom you give a big language style to begin hallucinating stuff,” he mentioned.

This explains the Alternative Engine’s placement in Netstock’s standard buyer dashboard. The tips are distinguished, however simply pushed aside. Google Doctors cramming 20 AI options down a consumer’s throat, this isn’t.

Moody mentioned he preferred that the AI isn’t in-your-face.

“We’re now not letting the AI engine make any stock choices {that a} human hasn’t checked out and screened and mentioned, ‘Sure, I believe that,’” he mentioned. “If and once we ever get to some degree the place they believe 90% of the stuff that it’s suggesting, perhaps we’ll take your next step and say ‘we’ll come up with keep an eye on now.’ However we’re now not there but.”

It’s a promising get started at a time when many endeavor deployments of generative AI appear to move nowhere.

But when the tech will get higher, Moody mentioned he’s however fearful in regards to the implications.

“Individually, I’m scared of what this implies. I believe there’s going to be a large number of exchange, and none folks is in point of fact positive what that’s going to appear to be at Bargreen,” he mentioned. It will result in there being fewer knowledge science mavens on team of workers, he instructed. However despite the fact that that suggests shifting the ones workers out of the warehouse and into the company place of business, he mentioned keeping wisdom is necessary.

Bargreen wishes individuals who “deeply perceive the speculation and the philosophy and will can rationalize how and why Netstock is making sure suggestions,” and to “be sure that we don’t seem to be blindly taking place” the incorrect trail, he mentioned.