Because the Trump management escalates its marketing campaign to reshape schooling, a provision within the “Giant Stunning Invoice” will elevate the tax on make a choice non-public schools’ endowments.

Donald Trump stops within the White Space Pass Corridor to hear the band on the conclusion of a “One, Giant, Stunning” match.

(Chip Somodevilla / Getty)

When President Trump first signed a invoice in 2017 getting rid of the tax-exempt standing many non-public college endowments loved, Rep. Kevin Brady—the important thing congressional Republican overseeing the tax code rewrite as chairman of the tough Techniques and Method Committee—mentioned the function of the brand new tax used to be “beautiful easy: It encourages schools to make use of their primary endowments to decrease the price of schooling.”

Within the face of an additional tax build up on a small subset of personal schools in the US, the GOP’s rationale has shifted. Brady’s successor, Rep. Jason Smith, has pitched the higher levies in an effort to grasp “elite, woke universities and nonprofits responsible.”

Tucked inside of Republicans’ 800-plus web page “One Giant Stunning Invoice” is a provision elevating the tax on income from make a choice non-public school endowments from its present 1.4 p.c price to any place from 4 to eight p.c. The levy is calculated via dividing the scale of the college’s endowment via the collection of non-international scholars they sign up, outputting a host representing the amount of cash held within the endowment consistent with pupil. The upper the per-pupil endowment price, the upper the tax. This creates an incentive construction, Republicans argue, that encourages schools to spend extra of its endowment on monetary help and the scholars’ finding out revel in, reasonably than hoarding its wealth into what are successfully hedge budget. However upper schooling professionals dispute this, saying that endowments serve to decrease the price of the schooling.

In a survey of 645 U.S. establishments via the Nationwide Affiliation of School and College Industry Officials, monetary help accounted for almost part of all endowment spending. Instructional techniques and analysis accounted for every other 17 p.c and college positions for almost 11 p.c. “College and body of workers surely take pleasure in this philanthropy, however scholars stay the main beneficiaries, as the majority of those assets is used to deal with pupil help and affordability,” NACUBO President and CEO Kara Freeman mentioned.

Expanding the tax burden for those schools may just divert budget from those techniques, negatively impacting get admission to to schooling, Phillip Levine, a senior nonresident fellow on the Brookings Establishment and an economics professor at Wellesley School, instructed The Country. “Those extremely endowed schools are the least pricey school choices for college kids beneath most likely $150,000 in source of revenue consistent with yr,” he mentioned. “They can do this on account of their massive endowments.”

Every other GOP qualm, within the phrases of Smith, is that faculties have used their multibillion greenback slush budget to push political ideology. “That ends now. If those establishments need to act like companies, we’ll deal with them like companies.”

Endowments, alternatively, have strict regulations governing them. The amount of cash that may be pulled from them yearly is regulated via state regulations. Donors additionally stipulate how their cash can be utilized. Some donate to endow professorships. Others donate to extend pupil monetary help, fund building of a development, or fund analysis.

Present in a in large part tax-exempt international because the early 1900s, upper schooling establishments have loved a federal tax carveout because of their undertaking and contribution to civil society. “Upper schooling completely has a civic duty,” Director of Put up-Secondary Coverage at Training Reform Now James Murphy mentioned in an interview, bringing up its skill to supply social mobility to its scholars and advance medical inquiry.

Steven Bloom, assistant vice chairman of presidency members of the family for the American Council on Training, went so far as to name American upper schooling “a countrywide safety asset.” “They’re a magnet for the sector’s brightest scholars and students,” he argued.

In a 2019 paper Mae C. Quinn, a legislation professor at Penn State, argued that faculties may just merely use the budget within the endowments in ways in which make upper schooling extra equitable, similar to on monetary help. Spending down those endowments would exempt them from a tax whilst concurrently reaping rewards deprived teams who’re underneath risk from the Trump management, she argues. “If wealthy schools merely make the most of extra in their huge financial savings to additional social justice, have an effect on poverty, and support public excellent—in particular in their very own at-risk communities—they’re going to now not simplest keep away from federal taxation but additionally start to deal with evaluations about their elitism and greed,” she wrote right through Trump’s first time period.

However because the Trump management escalates its marketing campaign to reshape U.S. post-secondary schooling thru withholding billions in federal budget and launching numerous investigations, this newest tax is observed as punitive via schooling stakeholders around the political spectrum.

“The tax is explicitly directed at ‘woke’ universities,” mentioned Neal McCluskey, the director of Heart for Instructional Freedom on the Cato Institute, a libertarian assume tank. “The tax gadget must now not be used to punish other people for his or her ideological ideals.” However McCluskey does assume that the government must bring to a halt all investment to raised schooling, “to not punish upper schooling however to observe the Charter, which supplies Washington neither the authority to fund pupil help nor maximum analysis.”

Common

“swipe left beneath to view extra authors”Swipe →

Hillsdale School follows this style. A conservative-leaning, non secular establishment, Hillsdale refuses any federal investment since its founding in 1844, stating that executive investment can include strings hooked up. But its president, Larry Arnn, publicly rebuked the endowment tax arguing that “it penalizes maximum significantly the ones establishments that experience selected the more difficult trail of independence, that refuse the entanglements of federal subsidy.”

Receiving a lot of its investment thru philanthropic items, the varsity’s president argued that “to tax those items is to tax philanthropy itself—to burden those that would carry burdens.” If the tax have been to enter impact, Arnn mentioned, “It might pressure us to chop assets, to restrict alternatives, to go burdens onto scholars and their households—all within the identify of a equity that’s not truthful.”

Different schools expressed equivalent alarm, predicting doomsday situations when Trump enacted this type of levy. On Friday, Trump signed the regulation, and the brand new tax, into legislation. The Country reached out to dozens of schools to know how they’re making ready for a possible tax hike and the way it might impact their scholars. Just one equipped a reaction, Baylor School of Drugs, to mention that they didn’t imagine the tax used to be supposed to focus on small, non-public scientific faculties. Their Normal Suggest Robert Corrigan added that “we’re lately operating with our elected representatives to impact a option to this factor.”

Those establishments have lobbied broadly on Capitol Hill towards such proposals to lift the tax, in step with public disclosure paperwork reviewed via The Country. Bloom lobbies about those taxation problems on behalf of the American Council on Training, a company composed of one,600 upper schooling establishments. His pitch to lawmakers towards the tax inspires conventional Republican subject matters of a small federal executive. Via taxing those income, he argues, “you’re taking the cash clear of different helpful functions and ship it to Washington.”

Some in upper schooling are nonetheless preventing towards the endowment tax, however are open to reforms. Murphy proposed leveraging the punitive measure of a tax to spur schools into operating towards “fascinating results.” In his view, this would come with tax breaks for many who get rid of legacy personal tastes in admissions or surpass a threshold within the share of scholars enrolled who’re Pell Grant eligible. Bloom mentioned the ACE desires the tax repealed or “reformed in ways in which support that incentivize faculties to do extra relating to monetary help, and analysis.”

Extra from The Country

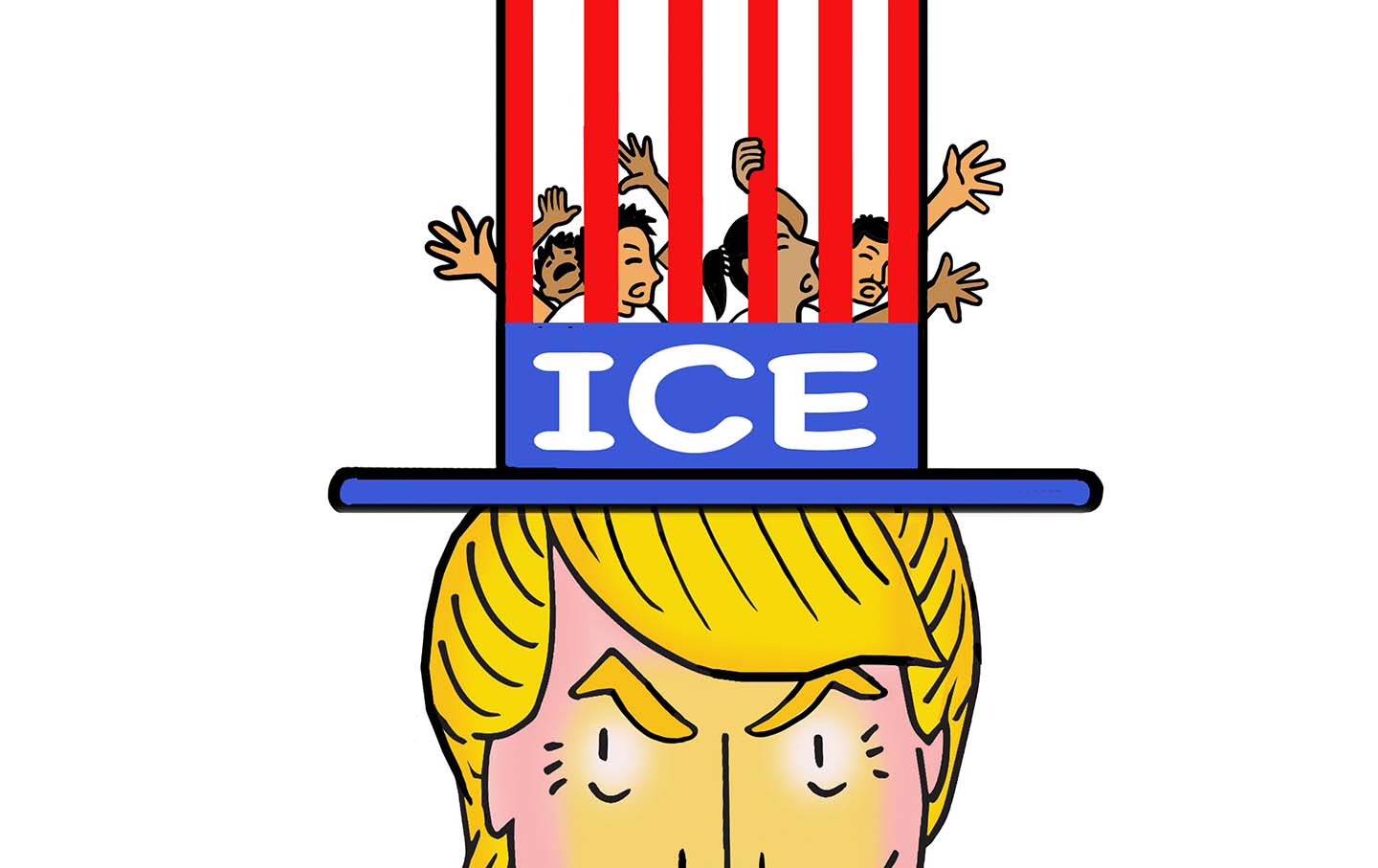

ICE is making extra arrests than ever, nearly all of other people detained this fiscal yr had no legal convictions, and Trump is pushing for extra enforcement.

Problems as soon as concept lengthy settled are actually up for grabs once more. However, “they’re now not going to get what they would like,” says Omar Jadwat of the ACLU’s Immigrants’ Rights Undertaking.