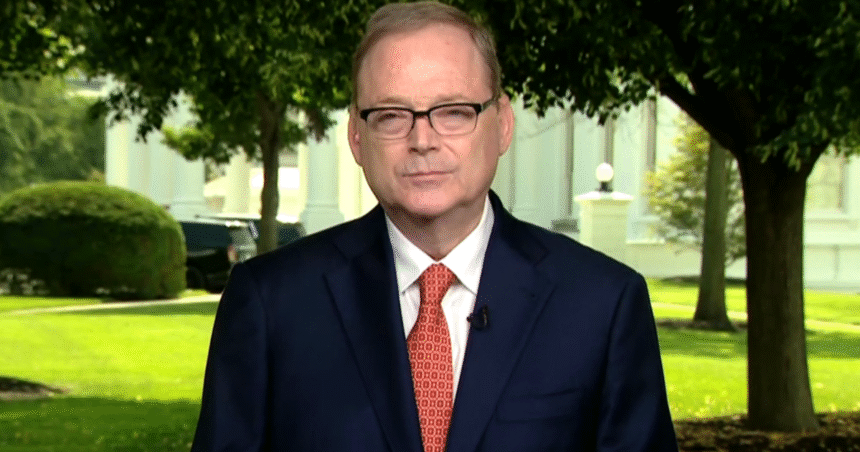

The next is the transcript of an interview with Kevin Hassett, Nationwide Financial Council director, that aired on “Face the Country with Margaret Brennan” on July 6, 2025.

WEIJA JIANG: We flip now to Kevin Hassett. He’s the director of the Nationwide Financial Council and one among President Trump’s most sensible advisors. He is additionally very talked-about on that driveway the place I am typically along a couple of dozen journalists. So, Kevin, thanks such a lot in your time this morning. I need initially industry, as a result of there is a large cut-off date bobbing up on Wednesday. As you already know, that 90-day pause on reciprocal price lists that the President introduced again in April is ready to finish. To this point, the United States has introduced a couple of offers; the United Kingdom, Vietnam, and you might be inching nearer to a last settlement with China. Do you are expecting to get any further offers performed with The us’s largest buying and selling companions by means of Wednesday?

KEVIN HASSETT: Yeah. First, I do must take- take a pause and percentage your ideas and prayers with the folks of Texas. It is an improbable, heartbreaking tale, and Kristi Noem and the President have recommended the government to throw the whole thing they have were given at serving to the survivors and serving to blank up that position. So, anyway, I am in point of fact heartbroken these days to peer those tales, and I need you to understand that within the White Space, everyone is placing each effort they may be able to into serving to the folks of Texas these days. On industry, there is going to be somewhat a little of stories this week. And, I feel, the headline of the inside track is that there are going to be offers which might be finalized. There are a complete quantity that Jameson Greer has negotiated with international governments, after which they will be letters which might be despatched to international locations pronouncing, here is how we expect it ought to head, since the offers are not complicated sufficient. And the headline goes to be that international locations are agreeing around the globe to open their markets as much as our merchandise, and to permit us to place some roughly tariff on their merchandise after they come into the United States. At precisely what the numbers shall be, shall be issues that you can in finding out within the information this week,.

WEIJA JIANG: Kevin, you mentioned there are going to be offers. For the ones in point of fact essential buying and selling companions, if there is now not a deal by means of Wednesday, is the President going to increase this pause?

KEVIN HASSETT: You realize, the US is at all times prepared to speak to everyone about the whole thing that is happening on this planet. And there are closing dates, and there are issues which might be shut, and so possibly issues will ward off the dead- previous the cut-off date, or possibly they want- in spite of everything, the President’s going to make that judgment.

WEIJA JIANG: And also you additionally discussed the ones letters that can get started going out the next day to come, in keeping with President Trump. He mentioned about 10 to twelve international locations will obtain them. Do you- are you able to let us know who is going to get one and what they are saying?

KEVIN HASSETT: As a result of- as a result of, once more, the a part of the letter that may be taking place proper is that we are with reference to a deal, we aren’t in point of fact happy with the growth that we are making on the deal, and so we are pronouncing, k, wonderful, we are going to ship a letter, however possibly you get a deal on the closing minute too. Till we see the whole thing that performs out, I feel that we want to simply cling our hearth and stay up for the inside track this week.

WEIJA JIANG: Is it honest to mention that the ones notices are going to visit our smaller buying and selling companions, as you negotiate with our larger ones?

KEVIN HASSETT: I feel that it may well be that it is going to be each. But in addition, do not omit, that once we’ve nice industry offers, our smaller buying and selling companions may transform a lot larger buying and selling companions. And that’s the reason, I feel, probably the most the explanation why international locations are racing to set offers up with us forward of the cut-off date.

WEIJA JIANG: I’ve to invite you concerning the closing dates, Kevin, to make those offers, since you simply discussed you might be at all times open. The president mentioned there is now not in point of fact any flexibility left between now and Wednesday. Lower than two weeks in the past, the Treasury Secretary Scott Bessent mentioned that offers could be wrapped up by means of Exertions Day. So, I’m wondering, you already know, if- how can firms plan if the function posts stay transferring? How can international locations negotiate if they do not even know the way a lot time they’ve left?

KEVIN HASSETT: Proper. Neatly, the tough outlines of the offers are turning into transparent to everyone, as a result of we’ve some offers like the United Kingdom, and the Vietnam deal which might be beginning to be, you already know, I suppose, tips for what may occur. However, probably the most issues that we are seeing that is in point of fact fascinating to me, is that persons are simply on-shoring manufacturing of the United States at a document price. As we now have had document activity advent, document capital spending, and that is even forward of the Giant, Gorgeous Invoice. And so, I feel what is taking place is that persons are responding to President Trump’s, you already know, attainable threats to have top price lists on international locations by means of transferring their job right here into the United States, which is developing jobs, greater than 2 million jobs, since he took workplace, and elevating wages. You realize, salary expansion is heading up against the in point of fact, in point of fact top pinnacles that we noticed in 2017. And so, I feel there is a race at the moment to get job into the United States. And, partially, that race has been kicked off by means of President Trump.

WEIJA JIANG: I consider after those reciprocal price lists have been introduced, you advised me that there have been about 15 offers that international locations have been bringing to the President. How shut, if it’s essential to give us any quantity in any respect, what quantity are we going to peer this week?

KEVIN HASSETT: Yeah, you can have- you will have to get that from Jameson and the President. I feel that, you already know, we now have observed a whole lot of offers which were finalized by means of our negotiators, after which the President unearths issues that might lead them to higher. And so, it’s- I am not going to get forward of the President at the selection of offers.

WEIJA JIANG: Ok, thank you, Kevin. We’re going to glance out for that. I wish to transfer now to the One Giant, Gorgeous Invoice that, after all, the President signed into regulation on Independence Day. You’ve got it, and now you must pay for it. And there is a consensus that this invoice provides significantly to the deficit. I do know that you’re so acquainted with those numbers. The Yale Finances Lab estimates it’s going to upload $3 trillion to the debt. The Tax Basis says this tax portion of the invoice may additionally upload $3 trillion to the deficit. The Committee for a Accountable Federal Finances, which elements in hobby at the debt, says it will upload as much as $5 trillion over the following decade. And in this very program, even Speaker Johnson spoke back within the affirmative when requested if this invoice would upload over $4 trillion to the deficit. I do know that the management says the invoice will if truth be told shrink the deficit by means of $1.5 trillion. Assist me perceive why there’s this type of drastic distinction between your quantity and all the ones others.

KEVIN HASSETT: Neatly- neatly, to start with, let’s understand that science isn’t democracy. Fact isn’t democracy. Our estimates are in keeping with modeling that we used closing time, when I used to be Chairman of the Council of Financial Advisers to mention what would occur if we had a invoice, how a lot expansion we might get. And we mentioned, and we have been criticized soundly, that we’d get 3% expansion. And we even had the in point of fact technical macroeconomic fashions that mentioned that we’d get 3% expansion. We run the similar fashions thru this tax invoice, it is even higher. And what we are seeing is that for those who get 3% expansion once more, then that is $4 trillion extra in earnings than the CBO and those different our bodies are giving us credit score for. They’ve been flawed up to now, and they are being flawed once more, in our trust. However, the item that disappoints me is if I put out a fashion and I say, hiya, here is what will occur, we are going to get 3% expansion. After which it seems it is 1.5% expansion, then, as an educational economist, as a scientist, then it is my accountability to mention, what did I am getting flawed? What did my fashion pass over? Those folks are not doing that. And that’s the reason the item that I in finding disappointing, as a result of we put peer-reviewed educational stuff at the desk, mentioned we are going to get that 3% expansion, after which we were given it proper closing time, and we imagine we are going to get it proper this time. However, for those who assume that 1.8% expansion is what will occur over the following 10 years, you then will have to trust the CBO quantity. However, there is every other a part of the CBO quantity that you wish to have to fret about. And that’s that if we do not move the invoice, that it is the largest tax hike in historical past. And with that massive tax hike, that after all, we might have a recession. The CEA says that we would have a couple of 4% drop in GDP and lose 9 million jobs. If we had a 4% drop in GDP and we misplaced 9 million jobs, what would occur to the deficit? And so, I don’t believe that the CBO has an excessively robust document. I don’t believe those puts have an excessively robust document. And what they want to do is get again to the fundamentals of taking a look at macroeconomic fashions. There is a in point of fact well-known macroeconomist at Harvard named Jim Inventory. They will have to return and skim the whole thing Jim Inventory has written for the closing 15 years, and fold the ones into their fashions, after which possibly shall we communicate.

WEIJA JIANG: I wish to communicate too, Kevin, about every other quantity that I do know you and the President disagree with, however that Democrats and plenty of Republicans are frightened about, and that’s the reason the CBO’s projection that as many as 12 million American citizens may lose Medicaid protection on account of this regulation. What’s the NEC’s estimate for what number of people may lose protection?

KEVIN HASSETT: Neatly- neatly, yeah. Let’s- let’s unbundle that a bit of bit. As a result of, first, at the CBO protection, so what are we doing? So, what we are doing is we are soliciting for a piece requirement. However, the paintings requirement is that you wish to have to be in search of paintings, and even doing volunteer paintings, and you do not want to do it till your youngsters are 14 or older. And so, the concept that is going to reason an enormous hemorrhaging in availability of insurance coverage, does not make numerous sense to us. After which, for those who have a look at the CBO numbers, for those who have a look at the large numbers, they are saying that persons are going to lose insurance coverage. About 5 million of the ones are individuals who produce other insurance coverage. They are individuals who have two sorts of insurance coverage. And so, due to this fact, in the event that they lose one, they are nonetheless insured. And so, the CBO numbers on that facet are not making any sense to us in any respect. However, at the different facet, return to 2017 once we had paintings necessities for Obamacare, they mentioned that we lose about 4 million insured between 2017 and 2019, and about double that over the following 10 years. And, in reality, the selection of insured went up. It went up somewhat a little, by means of greater than 10 million over the ones two years, as a result of the key is, one of the simplest ways to get insurance coverage is to get a task. And we now have were given a Giant, Gorgeous Invoice that is going to create numerous activity advent and numerous insurance coverage, and the CBO shouldn’t be accounting for that. And once more, they want to return and have a look at all of the issues that they were given flawed. You know that they are underestimating Medicaid spending by means of 20%. They will have to glance again at all of the issues they were given flawed, and give an explanation for what they will do to get it proper sooner or later, and to do a greater activity. And in the event that they do this, we’re going to take them extra severely. However at the moment, I don’t believe any severe philosopher may take them severely, as a result of they have performed so flawed, and flawed for see you later. Even back- for those who return to when President Obama handed Obamacare, they were given each unmarried quantity there flawed about what number of people would get personal insurance coverage and the way few folks would get Medicaid, and so forth. And so, their document on this modeling area is ready as dangerous as it is conceivable to be. In reality, it’s essential to, roughly, roll the roulette wheel and get a hold of a greater set of numbers, higher historical past, monitor document than CBO.

WEIJA JIANG: Kevin, what concerning the enhanced subsidies? Is that quantity flawed too? That the ACA permits about $705 for folks to assist pay for his or her medical health insurance. That does not sound just like the waste, fraud, and abuse that I do know you and the President have mentioned getting rid of. That simply appears like individuals who can not come up with the money for protection, and now it will be much more so with the subsidies long past.

KEVIN HASSETT: Proper. Neatly- neatly, for those who’re- in case you are taking a look at the- the exchange within the tax at the suppliers, which is one thing that has been a key speaking level for the Democrats, they are saying that that is going to near down rural hospitals. What has took place is that, somewhat than let the states- the states have this sport the place they provide a greenback to a sanatorium after which the government fits the greenback, after which the state taxes one of the most greenback away. In different phrases, that we have got an settlement with the states that they will fit, however then they’ve this they’ve this trick the place they tax the hospitals when they give them the cash, so in point of fact, it is the federal govt giving them the cash. And that’s the reason why we now have been overspending Medicaid by means of 20% since this trick began taking place. And so, what we now have performed is that we now have put a haircut on that. However, we now have additionally put $50 billion right into a agree with fund to ensure that the agricultural hospitals are there to regard the unwell. So, I feel it is a prudent shape. It is sound budgetary politics. And I feel that no one’s going to lose their insurance coverage.

WEIJA JIANG: Kevin Hassett, we can stay up for how that ages. Thanks very a lot. In point of fact respect —

KEVIN HASSETT: – And if I am getting it flawed, we’re going to test, and we’re going to discuss why I were given it flawed. I promise.

WEIJA JIANG: Thanks. We’re going to have you ever again. Thanks very a lot, Kevin.