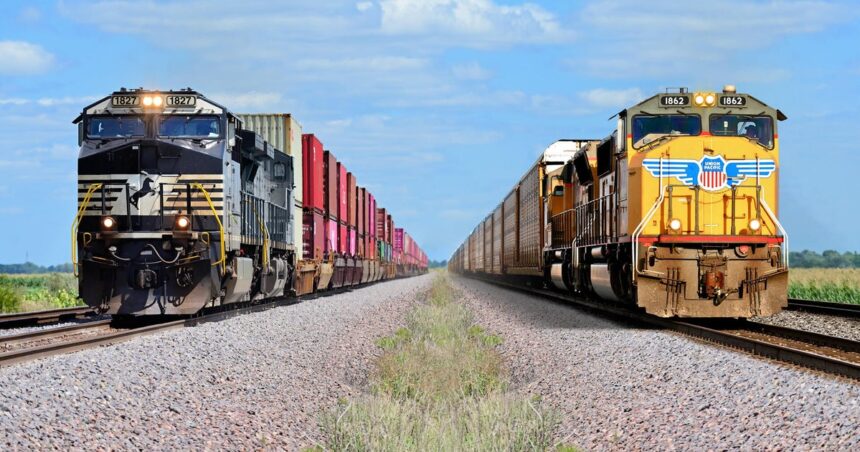

Union Pacific needs to shop for Norfolk Southern in a $85 billion deal that will create the first transcontinental railroad within the U.S, and doubtlessly cause a last wave of rail mergers around the nation.

The proposed merger, introduced Tuesday, would marry Union Pacific’s huge rail community within the West with Norfolk’s rails that snake throughout 22 Japanese states, and the District of Columbia.

The country used to be first connected by means of rail in 1869, when a golden railroad spike used to be pushed in Utah to signify the relationship of East and West Coasts. But no unmarried entity has managed that coast-to-coast passage.

The railroads argue a merger would streamline deliveries of uncooked fabrics and items national by means of getting rid of delays when shipments are passed off between railroads. The AP first reported the merger talks previous this month every week earlier than the railroads showed the discussions final week.

Any deal could be carefully scrutinized by means of antitrust regulators that experience set an excessively top bar for railroad offers after earlier consolidation within the business led to giant backups and tousled site visitors.

Force on last railroads

If the deal is licensed, the 2 last main American railroads — BNSF and CSX — will face super drive to merge to create a moment transcontinental railroad so they may be able to compete. The continent’s two different main railroads — Canadian Nationwide and CPKC — might also become involved. The Canadian rails span all of that country and feed into The us. CPKC rails stretch south into Mexico

Some giant shippers like chemical crops within the Gulf could also be cautious of the deal because of fears of a monopoly that might would wield immense affect over charges, however different main rail consumers, like Amazon and UPS, could also be in desire if it manner programs will arrive extra temporarily and reliably. The ones giant corporations, in conjunction with unions and communities around the nation that the railroads move, can have a possibility to weigh earlier than the U.S. Floor Transportation Board.

Customers may just receive advantages if the transcontinental rail does cut back transport charges and supply occasions. Union Pacific mentioned that blended, the railroads would toughen supply occasions.

There is hypothesis that this deal would possibly win approval underneath the pro-business Trump management, however the STB is lately frivolously cut up between two Republicans and two Democrats. The board is led by means of a Republican, and Trump will appoint a 5th member earlier than this deal can be regarded as.

Union Pacific is providing $20 billion money and one percentage of its inventory to finish the deal. Norfolk Southern shareholders would obtain one UP percentage and $88.82 in money for every certainly one of their stocks as a part of the deal that values NS at more or less $320 consistent with percentage. Norfolk Southern closed at simply over $260 a percentage previous this month earlier than the primary reviews speculating a couple of deal.

Union Pacific’s inventory fell just about 2% to $224.98 in premarket buying and selling, whilst Norfolk Southern’s inventory dipped greater than 3% to $277.40.

Union Pacific CEO Jim Vena, who has championed a merger, mentioned lumber from the Pacific Northwest and plastics produced at the Gulf Coast and metal made in Pittsburgh will all achieve their locations extra seamlessly.

“It builds upon President Abraham Lincoln’s imaginative and prescient of a transcontinental railroad from just about 165 years in the past, and can herald a brand new technology of American innovation,” Vena informed traders Tuesday.

From 30 to six

U.S. railroads have already gone through in depth consolidation. There have been greater than 30 main freight railroads within the early Nineteen Eighties. These days, six main railroads maintain the vast majority of shipments national.

Western rival BNSF, owned by means of Berkshire Hathaway, has the battle chest to pursue an acquisition of CSX, to the east, if it chooses. CEO Warren Buffett is sitting on greater than $348 billion money and the consummate dealmaker might need to swing for the fences one final time earlier than stepping down as deliberate on the finish of the 12 months.

Buffett just lately threw chilly water on reviews that he had enlisted Goldman Sachs to advise him on a possible rail deal in an interview with CNBC, however he hardly makes use of funding bankers anyway. Buffett reached an settlement to shop for the portions of the BNSF railroad he did not already personal for $26.3 billion after a non-public assembly with its CEO greater than a decade in the past.

But there may be fashionable debate over whether or not a big rail merger could be licensed by means of the Floor Transportation Board, which has established a top bar for consolidation within the an important rail business.

That is in large part because of the aftermath of a consolidation in the united statesnearly 30 years in the past that concerned Union Pacific. It merged with Southern Pacific in 1996 and the tie-up ended in a longer duration of tousled site visitors on U.S. rails. 3 years later, Conrail used to be divvied up by means of Norfolk Southern and CSX, which ended in extra backups within the East.

“We are dedicated to creating positive that does not occur on this case,” mentioned Norfolk CEO Mark George. He added that the railroads will spend the following two years making plans for a clean integration earlier than this deal would possibly get licensed.

Simply two years in the past, the STB licensed the primary main rail merger in additional than twenty years. In that deal, which used to be supported by means of giant shippers, Canadian Pacific received Kansas Town Southern for $31 billion to create the CPKC railroad.

There have been compelling elements in that deal, alternatively, that blended the 2 smallest main freight railroads. The blended railroad, regulators reasoned, would receive advantages industry throughout North The us. The deal introduced Tuesday would merge the country’s greatest freight railroad, with the smallest.

Union Pacific and Norfolk Southern mentioned they be expecting to post their utility for approval throughout the subsequent six months and hope the deal would get licensed by means of early 2027. They expect that they might be capable of do away with $1 billion in prices once a year, however Vena mentioned that each and every union employee at each railroads will have to nonetheless have a task. The railroads additionally expect they might be capable of spice up income by means of no less than $1.75 billion every 12 months by means of successful extra enterprise from trucking corporations and different railroads.

On Tuesday, Norfolk Southern reported a $768 million second-quarter benefit, or $3.41 consistent with percentage, as quantity grew 3%. That is up from $737 million, or $3.25 consistent with percentage, a 12 months in the past, however the effects had been suffering from insurance coverage bills from its 2023 East Palestine derailment and restructuring prices.

With out the one-time elements, Norfolk Southern made $3.29 consistent with percentage, which used to be slightly below the $3.31 consistent with percentage that analysts surveyed by means of FactSet Analysis predicted.