Chair of the White Space Council of Financial Advisers Stephen Miran stated that some international locations which are negotiating with the United States in just right religion may just see price lists not on time as President Donald Trump’s closing date to strike industry offers closes in.

Talking with ABC Information’ “This Week” anchor George Stephanopoulos, Miran hedged on what offers are within the works.

“On price lists, the president’s closing date is drawing near for the offers. You have most effective observed 3 offers thus far. What will have to we think subsequent?” Stephanopoulos requested.

“I am nonetheless positive that we are going to get various offers later this week. A part of this is as a result of all of the negotiating is going via a sequence of steps that result in a end result timed with the closing date,” Miran stated.

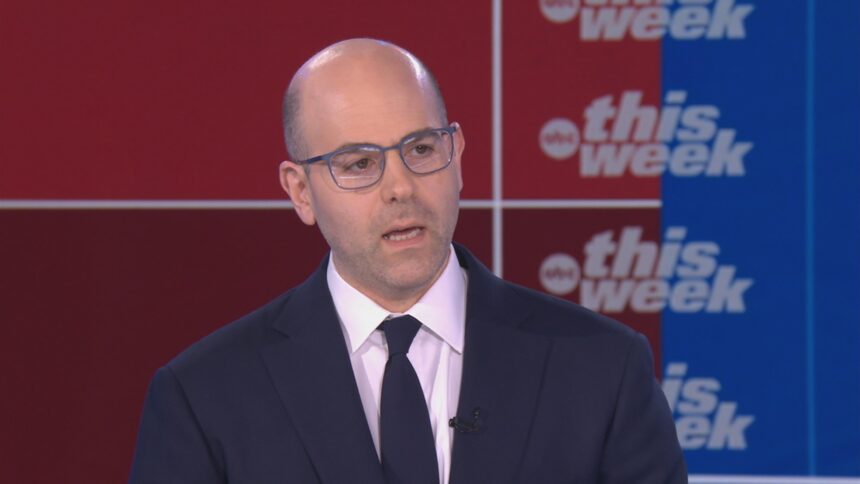

Chairman of the White Space Council of Financial Advisers Stephen Miran seems on ABC Information’ “This Week With George Stephanopoulos” on July 6, 2025.

ABC Information

Pressed on if those different offers fail to return via and if Trump would prolong the closing date, Miran indicated that may be imaginable.

“Neatly, my expectation can be that international locations which are negotiating in just right religion and making the concessions that they want to get to a deal, however the deal just isn’t there but as it wishes extra time, my expectation will likely be that the ones international locations get a roll, , type of get the date rolled,” he stated.

Requested which international locations may just see that date shifted, Miran refused to elaborate, however stated that he has heard just right issues about talks with Europe and India.

“I’d be expecting that various international locations which are within the procedure of creating the ones concessions, , they may see their date rolled. For the international locations that are not making concessions, for the international locations that are not negotiating in just right religion, I’d be expecting them to type of see upper price lists,” Miran stated. “However once more, the president will make a decision later this week and within the time following whether or not or no longer the international locations are doing what it takes to get get right of entry to to the American marketplace like they have got grown familiar with.”

Former Treasury Secretary Larry Summers seems on ABC Information’ “This Week With George Stephanopoulos” on July 6, 2025.

ABC Information

Stephanopolous was once additionally joined via former Treasury Secretary Larry Summers, who balked on the doable financial advantages of Trump’s price lists.

“It most probably will gather some income at the price of upper inflation for American customers, much less competitiveness for American manufacturers,” Summers stated. “So upper costs, much less competitiveness, and no longer actually that a lot income relative to what is being given to the very rich on this [budget] invoice.”

Listed here are extra highlights from Miran and Summers’ interviews:

Miran on CBO estimates for Trump’s megabill

Stephanopoulos: Why will have to we no longer imagine the CBO after they say that one thing drawing near slightly greater than 11 million individuals are going to be — are going to lose their well being care protection on account of the Medicaid cuts?

Miran: Neatly, as a result of they have got been mistaken previously. When Republicans repealed the person mandate penalty throughout the Tax Cuts and Jobs Act within the president’s first time period, CBO predicted that there was once going to be about 5 million other people shedding their insurance coverage via 2019. And what? The quantity was once no longer very considerably modified in any respect. It was once a tiny fraction of that. And so, they have got been mistaken previously. And glance, if we do not move the — if we did not move the invoice, 8 to 9 million other people would’ve misplaced their insurance coverage evidently, on account of the largest tax act in historical past growing an enormous recession. One of the best ways to verify individuals are insured is to develop the financial system, get them jobs, get them running, get them insurance coverage via their employer. Growing jobs, making a booming financial system is all the time one of the best ways to get other people insured.

Miran on previous tax cuts

Stephanopoulos: You assert that is all going to turbocharge expansion. Now we have observed some revel in with this again — in Ronald Reagan’s day, again in 1981. He had large tax cuts. The expansion did not come, they usually needed to finally end up elevating taxes for a number of years after that. Involved that might occur once more?

Miran: Neatly, like I stated prior to, , historical past’s on our aspect. If you happen to take a look at what came about within the president’s first time period, expansion soared and there was once no actual subject material, , significant long-term decline in income. Earnings as a proportion of GDP was once 17.1% remaining yr, the similar because it was once prior to the Tax Cuts and Jobs Act. So, you were given this massive surge in expansion on account of the Tax Cuts and Jobs Act. There was once no subject material long-term decline in income. Company income even went up as a proportion of GDP from 1.6 to at least one.9%. And the expansion delivered. And we think the similar factor to occur this time.

Summers on cuts to the protection web

Stephanopoulos: In The New York Occasions this week, you and Robert Rubin, who additionally served as president, as Treasury secretary, referred to as this invoice “unhealthy,” stated it “posed an enormous chance to the financial system.” What are the ones dangers?

Summers: George, simply to begin with, what your other people were describing is the largest lower within the American protection web in historical past. The Yale Price range Lab estimates that it is going to kill, over 10 years, 100,000 other people. This is 2,000 days of demise like we have now observed in Texas this weekend. In my 70 years, I’ve by no means been as embarrassed for my nation on July Fourth.Those upper rates of interest, those cutbacks in subsidies to electrical energy, those discounts within the availability of housing, the truth that hospitals are going to must deal with those other people and move at the prices to everyone else, and that’s the reason going to imply extra inflation, extra chance that the Fed has to boost rates of interest and run the danger of recession, extra stagflation, that is the chance dealing with each and every middle-class circle of relatives in our nation on account of this invoice. And for what? One million bucks over 10 years to the highest 10th of a p.c of our inhabitants. Is that the best possible precedence use of federal cash presently? I do not believe so. It is a shameful act via our Congress and via our president this is going to set our nation again.

Summers on claims of financial expansion

Stephanopoulos: A part of the president’s argument is that financial expansion sparked via the invoice will alleviate the hazards that you just discuss right here. The chair of the Council of Financial Advisers is up subsequent and his council issued a file this week projecting $11 trillion in deficit aid from expansion, upper tax income and financial savings on debt bills. How do you reply to that?

Summers: It’s, respectfully, nonsense. None folks can forecast what is going to occur to financial expansion. What we will forecast is that after other people have to carry govt debt as an alternative of having the ability to make investments it in new capital items, new equipment, new structures, that makes the financial system much less productive. What we will forecast is that after we’re making an investment much less in analysis and construction, making an investment much less in our colleges, that there’s a unfavourable affect on financial expansion. There’s no economist any place, and not using a robust political schedule, who’s pronouncing that this invoice is a good for the financial system. And the overpowering view is that it’s most probably going to make the financial system worse. Take into accounts it this fashion. How lengthy can the arena’s largest debtor stay the arena’s largest energy? And that is piling extra debt onto the financial system than any piece of tax regulation in greenback phrases that we’ve got ever had.